Forecasting is an essential part of business. All managers use forecasts to decide how much inventory to buy, the number of people to hire, annual advertisement spending, etc. Profits are higher, and decision making is easier with the right forecasts. Many time series forecasting models have been developed to aid businesses to make the right forecasts and improve profits.

Our statistics tutors can provide live online tutoring and homework help on time series forecasting. There are various time series forecasting methods and techniques. Work with our statistics tutors online to learn the concepts underlying the various time series forecasting methods and techniques. Apply the time series forecasting methods on sample data from various industries to reinforce your forecasting techniques. Use commonly available time series forecasting tools, including Microsoft Excel or specialized forecasting software or simulation software such as Crystal Ball. Time series forecasting can be done using Python or R programming too.

Time Series Decomposition

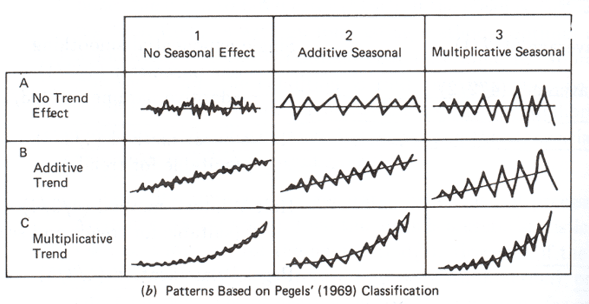

It is useful to split a time series into several components for analysis. The general representation of the decomposition approach is: Y_t=f(S_t, T_t, E_t) where

- Yt = Actual time series at period t

- St = Seasonal component at period t

- Tt = trend-cycle component at period t

- Et =Irregular or error component at period t

Two forms of classical decomposition:

- Additive Form

- Y_t=S_t + T_t+E_t

- Seasonally adjusted data is given by

- Y_t-S_t= T_t+E_t

- Multiplicative Form

- Y_t=S_t X T_t X E_t

- Seasonally adjusted data is given by

- Y_t/S_t = T_t X E_t

Time Series Forecasting Topics

A sample of the forecasting methods, topics and tools you can learn with Graduate Tutor’s statistics tutors is listed below. Please email us if you do not find what you are looking for and we will be happy to assist you.

- Time Series Forecasting Methods

- Measuring Accuracy of time series forecasting methods

- Combining Forecasts

- Stationary Models for Business Forecasts

- Moving Averages for Business Forecasts

- Time Series Forecasting with the Moving Average Model

- Weighted Moving Averages for Sales Forecasts

- Forecasting with the Weighted Moving Average Model

- Exponential Smoothing

- Forecasting with the Exponential Smoothing Model

- Time Series Forecasting with Seasonality effects

- Time Series Forecasting Model for Stationary Data with Additive Seasonal Effects

- Time Series Forecasting Model with Stationary Data with Multiplicative Seasonal Effects

- Time Series Forecasting Models for data with Trend

- Double Moving Average Time Series Forecasting Models

- Double Exponential Smoothing {Holt’s Method)

- Time Series Forecasting with Holt’s Method

- Time Series Forecasting with Holt-Winter’s Method for Additive Seasonal Effects

- Time Series Forecasting with Holt-Winter’s Additive Method

- Holt-Winter’s Method for Multiplicative Seasonal Effects

- Forecasting with Holt-Winter’s Multiplicative Method

- Modeling Time Series Trends Using Regression

- Time Series Forecasting with the Linear Trend Model

- Forecasting with the Quadratic Trend Model

- Time Series Forecasting with the Quadratic Trend Model

- Modeling Seasonality with Regression Models

- Adjusting Trend Predictions with Seasonal Indices

- Computing Seasonal Indices

- Forecasting with Seasonal Indices

- Refining the Seasonal Indices

- Seasonal Regression Models

- The Seasonal Model

- Time Series Forecasting with the Seasonal Regression Model

- Time Series Forecasting using the Crystal Ball Predictor

- Using CB Predictor

Executives use time series forecasting to do sales forecasting, financial forecasting, inventory, forecasting, etc. Time series is a set of observations on a quantitative variable collected over time. Businesses collect various data to aid in financial forecasting, sales forecasting, technical analysis, business inventory forecasting, etc. These variables are analyzed using various data analysis techniques including time series forecasting to aid in decision making.

General Statistical Properties of a Forecast

It is helpful to keep these general properties of a forecast in mind as you work on time series forecasting. Given random variables X, Y, W, Z:

- Mean (expected value, location):

- E(aX+bY+c)=aE(X)+bE(Y)+c

- Variance (deviance, dispersion):

- var(aX+bY+c)=a^2 var(X)+b^2 var(Y)+a⋅b⋅cov(X,Y)

- Covariance (joint variability):

- cov(X,Y)=0, if X,Y are independent

- cov(aX+b,cY+d)=ac*cov(X,Y)

- cov(X+Y, W+Z)=cov(X,W)+cov(X,Z)+cov(Y,W)+cov(Y,Z)

- cov(X,X)=var(X)

Regression Forecasting Models

Three common time trends in regression models:

- Linear trend

- E(y_t )=β_0+β_1 t

- The quadratic function of time

- E(y_t )=β_0+β_1 t+β_2 t^2

- Exponential function of time

- E(y_t )=β_0 e^(β_1 t)

- Run regression in the natural log form

- E(lny_t)=lnβ_0+β_1 t

Other operations research and statistics topics that our statistics tutors can assist you with include: