What are stock screeners?

Stock screeners are tools used to search thousands of stocks quickly and select stocks for further research. Researching thousands of investment ideas is impossible given the limited time available. So rather than study random stocks or equity ideas, it is best to study equity stocks with a higher probability of being high potential investments. Here is where equity screeners or stock screeners come into play. Stock screeners or equity screeners help you narrow down the universe of stocks to investigate into a more manageable number.

Today you have a variety of online stock screeners and tools. Before technology enabled these software stock screeners, stock screeners were lists ordered according to specified criteria.

How do you select the criteria to apply in stock screens?

Individual investment styles and personalities drive this answer.

There is no correct answer here. The stock screening criteria you select and what stock screens are best depends on your investment styles, needs, and personalities.

For example, a value investor may look at companies with a price/book ratio of less than one! Benjamin Graham wanted a price less than net working capital. Dividend-driven investors may have dividend yields as their stock screening criteria. Or dividend growth over the last 10 years. @DividendGrowth on twitter, who blogs at dividendgrowthinvestor.com, has the following criteria for his stock screen.

- Be a member of the S&P 500

- Have increased dividends every year for at least 25 consecutive years

- Meet minimum float-adjusted market capitalization and liquidity requirements defined in the index inclusion and index exclusion rules below.

Dave Fish has a dividend champion list – a list of companies that have a 25-year record of annual dividend increases! h/t @DividendGrowth

Some investment analysts use a percentage off recent (1 year) high as a screening criterion.

Multiple criteria can be used

You do not have to pick only one criterion. Often multiple criteria are used in stock screens. You can specify various criteria the company or stock must meet, including specifying the company size, country of domicile, valuation, growth, etc. For example, you may want to invest only in US stocks, with a market cap higher than $500 million, headquartered in the US, with a PE multiple less than 20.

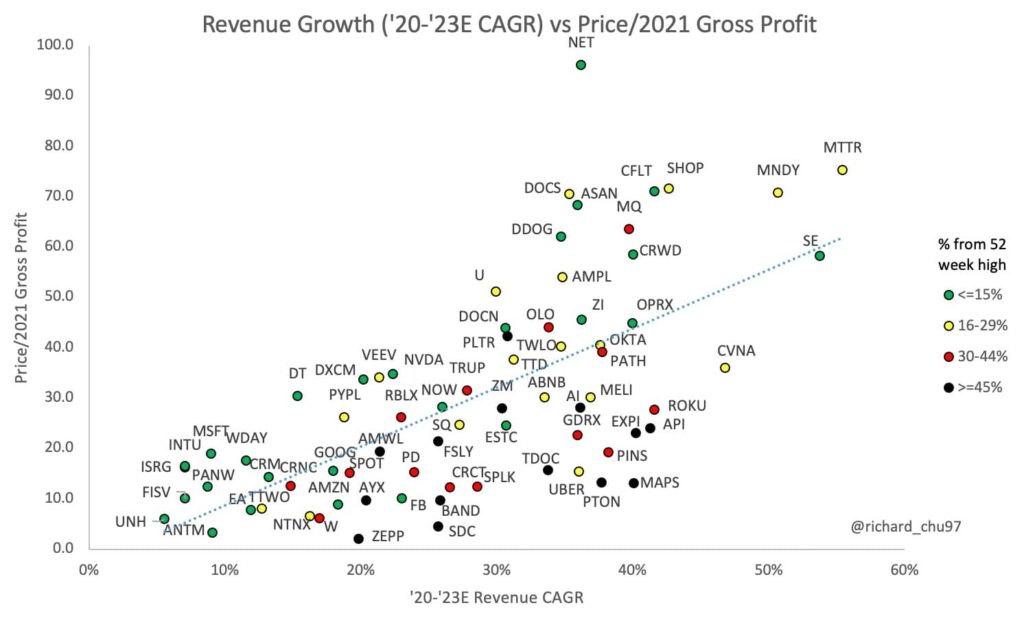

An excellent example of multiple criteria and beautiful visualization comes from Richard Chu (@richard_chu97 on Twitter).

Richard uses Price/Gross profit on the Y-axis and Expected revenue CAGR on the x-axis and uses color codes to represent % down from 52-week highs!

Types of Stock Screeners

Stock screeners or equity screeners help you narrow down the universe of stocks to investigate into a more manageable number.

Free vs. Paid Stock Screeners

There are several free screeners available online. Some of these include finance.yahoo.com, Morningstar.com’s basic screener, finviz, tradingview, Reuters, etc. (some may require registration). Many brokerage accounts and apps also offer free stock screeners, including Vanguard, TD Ameritrade, etc.

Many paid investment and data providers also provide screeners. These include ValueLine, Bloomberg, Refinitiv, etc. Some services have a basic screener that is free and then a paid screener with many more features or stocks covered. For example, Morningstar.com has a free basic screener and a paid advanced screener.

Depending on the amount of time you have on hand and the size of your portfolio, you can go with a free or paid service. Most investors use a variety of stock/investment data sources, and most of these providers also include stock screeners. We do not recommend paying for stock screeners separately.

Ready-made vs. Customizable Screeners

Most of the equity screeners listed above have ready-made stock screeners. Some of the screeners, Yahoo finance, for example, has includes:

- Undervalued Growth Stocks

- High Yield Bonds

- Most Shorted Stocks

- Tech Growth Stocks

- And many more ready-made screener lists.

What features should you look for in selecting screeners?

Some of the factors we recommend you understand when selecting your equity screener include:

Range of stocks involved: Your stock screener selects stocks that meet the specified criteria from a broader list of equities or investment opportunities. What stocks, equities, or investment opportunities are included in this universe list of stocks? Is it only US stocks or US, Canada and EU stocks? Does it include Asian/African stocks? How many stocks are included? Are micro-caps included? For example, value line has different levels of subscriptions – one subscription covers 1700 stocks (as of this writing), others consist of a far more extensive range of stocks, etc.

What are the factors that you can specify for your screen? Many free stock screeners only have a handful of criteria. For example, Yahoo finance only has market cap, PE, etc.

Other stock screeners have over a hundred factors you can use as criteria for your screen.

Customizability: More sophisticated stock screeners allow you to customize your screening criteria. You can use existing data points to create your own ratios. For example, I may want to look at a unique ratio – EV/Operating+investing cash flow instead of the more common EV/EBITDA.

Output export features: Some screeners allow you to export your screens into various file formats. Others don’t. So if exporting your selected stocks into a Microsoft Excel file is essential, please check if this feature is available.

Visual presentation: Some screeners allow you to present the data in nice graphs/charts. Scatter graphs are a great way to show the data and help you select stocks. You saw Richard Chu’s visualization above.

With these thoughts, we turn it over to you. Enjoy the hunt for investment ideas starting with careful stock screening. Remember two things:

- Your investing goals must drive stock screens; and

- Using stock screens to identify stocks to research is only approximately 5% of the work involved in being a good investor!

Good luck with your investing. If we can assist you to understand any aspect of investing from financial statement analysis, equity valuation with DCF modeling, strategy evaluation, or anything else, please do let us know.