The Financial Markets course at the McDonough School of Business is offered to students of the various MBA programs and the MSF program early in the first year. It is considered a foundational core finance course. However, since it is taught at the graduate level, the course ramps up very quickly, and students can expect to put in a lot of work to stay on top of the Financial Markets course at the McDonough School of Business.

GraduateTutor’s finance tutors offer live online finance tutoring for Financial Markets and other corporate finance, investment, and portfolio management courses offered at Georgetown University. This page covers the following topics:

- MBA programs Supported at the McDonough School of Business

- Objectives of the Financial Markets Course at McDonough School of Business

- Financial Markets Course Content

- Prerequisites for Financial Markets Course

- Teaching Format for the Financial Markets Course at McDonough School of Business

- Financial Markets Course Tutoring Plan

- Case Studies Used in Financial Markets at McDonough School of Business

- Required Textbook for Financial Markets at McDonough School of Business

- Key Questions Addressed in Financial Markets at McDonough School of Business

- Teaching Faculty for the Financial Markets Course

- Grading in the Financial Markets Course at McDonough School of Business

- Order of Topics in Financial Markets Course at McDonough School of Business

- Tutoring for Financial Markets at the McDonough School of Business, Georgetown University

Tutoring for MBA programs available at the McDonough School of Business, Georgetown University

In addition to tutoring the Financial Markets at McDonough School of Business, GraduateTutor also provides private one-on-one tutoring for all the quantitative courses at the various MBA programs available at the McDonough School of Business, Georgetown University listed below:

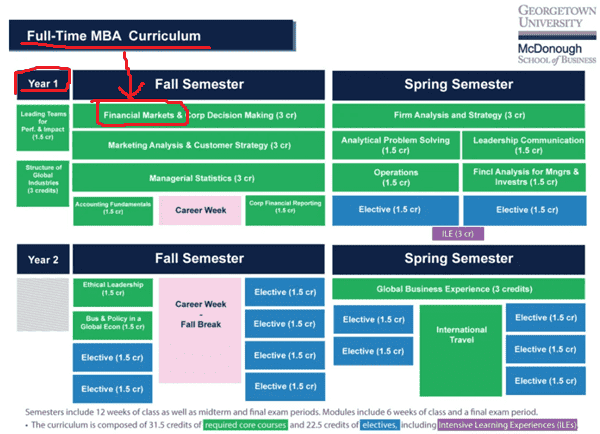

- Full-Time MBA – A traditional two-year program focused on building a strong foundation in business fundamentals, with opportunities for internships and global experiences.

- Flex MBA – A part-time program with evening and weekend classes designed for working professionals to balance their careers, personal lives, and education.

- Executive MBA – A program tailored for experienced professionals looking to enhance their leadership skills and strategic knowledge to accelerate their careers.

- Global Executive MBA – A program that includes international residencies and focuses on global business perspectives, ideal for professionals seeking a global approach to leadership and strategy.

Objectives of the Financial Markets Course at McDonough School of Business, Georgetown University

The Financial Markets course at the McDonough School of Business is designed to equip students with a comprehensive understanding of key financial principles that drives financial markets and the functioning of financial markets.

This course is intense and moves at a very fast pace. The Financial Markets course at the McDonough School of Business starts with the basics of finance and covers a wide spectram of areas in finance from bonds, stocks, valuation, portfolio theory, etc. all in one stemester making it particularly demanding.

By the end of this course, students should be able to:

- Value different types of bonds, including government and corporate ones.

- Understand what shapes the Treasury yield curve.

- Use the Discounted Dividend Model to value stocks.

- Estimate the risk and expected returns for both stocks and bonds.

- See the advantages of diversification in a portfolio.

- Apply the Capital Asset Pricing Model (CAPM) and explore its alternatives, like the Fama and French 3-Factor Model.

- Dive into the efficient market hypothesis and behavioral finance to understand how markets really work.

- Calculate alpha and understand the challenges that come with it.

- Tackle complex financial problems with the right tools.

Financial Markets Course Content at McDonough School of Business, Georgetown University

The Financial Markets course at the McDonough School of Business starts off with the time value of money, government bond valuation, Macauley and Modified duration, yield curves, spot and forward rates, nominal and real returns, etc. These concepts are then applied to corporate bond and stock valuation including understanding bond covenants, discounted dividend model, multiples and comparable valuation.

The Financial Markets course at the McDonough School of Business then moves into portfolio management with optimal portfolios, the Markowitz efficient frontier method, the Capital Asset Pricing Model (CAPM), and estimating a security’s expected return and introduces behavioral finance to students.

Prerequisites for Financial Markets Course

The Financial Markets course is the first course in the Master of Science in Finance (MSF) Program at Georgetown University. The course stats with the basics in finance for example the time value of money, discounting, present value, future values, etc. but, it assumes that students have a fundamental understanding of basic financial principles and so goes through it very rapidly. However, there is no specific prerequisite or prior coursework is required.

Teaching Format for the Financial Markets Course at McDonough School of Business

The course is delivered through a combination of pre-recorded video presentations, live sessions called MSFLive sessions, and case studies. Each module or unit includes assigned readings, practice problems, and discussion forums to facilitate a deep understanding of the material. The course emphasizes active learning, with students expected to prepare thoroughly for each MSFLive session.

Financial Markets Course Tutoring Plan

At GraduateTutor, students are supported by a dedicated tutor who provides regular support as needed. Both one on one private tutoring as well as group tutoring is offered for Masters and MBA students. Given the rapid pace of the financial markets program at McDonough, we recommend that students stay ahead of the course by preparing for the class with one of our MBA level finance tutors. This way the class serves as a way to reinforce your finance knowledge and learn new angles presented by the faculty (if any).

Case Studies Used in Financial Markets at McDonough School of Business

A large part of the course follows the typical lecture (in person & video/MSFlive), practice questions, and quiz format, and the course is supplemented with case studies. Case studies play a critical role in the Financial Markets course, helping students apply theoretical finance knowledge to real-world scenarios. The finance cases used in this course include:

- Warren E. Buffett, 1995 – Analyzing investment strategies.

- Fixed Income Arbitrage in a Financial Crisis (A) – US Treasuries in November 2008.

- Roche Holding AG: Funding the Genentech Acquisition – Corporate finance and securities valuation.

- Partners Healthcare – Risk and return in financial markets.

- Behavioral Finance at JP Morgan Case – Examining behavioral finance theories.

Required Textbook for Financial Markets at McDonough School of Business

The primary textbook for the Financial Markets course is Principles of Corporate Finance by Brealey, Myers, Allen, and Edmans. A few earlier editions are also viable. Additionally, A Random Walk Down Wall Streetby Burton G. Malkiel is also required reading. These books provide the foundational knowledge necessary for understanding the course content and are supplemented by case studies and academic articles. No additional books are suggested.

Key Questions Addressed in Financial Markets at McDonough School of Business

The course explores several key questions central to the understanding of financial markets, including:

- How do we value bonds and stocks? What are the principles behind bond and stock valuation?

- What’s the relationship between risk and return in the markets? How do risk and return interact in financial markets?

- Is the market truly efficient, or do behavioral factors play a bigger role? What is the relevance of the efficient market hypothesis versus behavioral finance?

- How does diversification help manage risk in a portfolio? How can diversification reduce risk in a portfolio?

- What’s the impact of models like CAPM on investment decisions? What are the implications of the CAPM and its alternatives in practical investing?

Teaching Faculty for the Financial Markets Course

A number of professors from the Finance department at Georgetown University have taught this course. Currently, the financial markets course is led by Professors Allan Eberhart and Allen Ammerman. Professor Eberhart handles the majority of the modules, focusing on topics such as bond and stock valuation, risk and return, and the efficient market hypothesis. Professor Ammerman contributes to the module on valuing government bonds and also serves as the Director of Academic Operations for the MSF Program.

Some of the past faculty who have taught Financial Markets at the McDonough School of Business, Georgetown University, include:

- Professor Reena Aggarwal with expertise in financial markets, corporate governance, and international finance has taught the Financial Markets course in the past.

- Professor Jeffrey H. Harris with a background in market microstructure and securities trading has provided practical insights into the functioning of financial markets.

- Professor Lynn Doran who has expertise in fixed income and derivative markets has previously taught the Financial Markets course adding a lot of debt content.

Grading in the Financial Markets Course at McDonough School of Business

Grading in the Financial Markets course is based on a combination of problem sets, discussion posts, attendance, participation in MSFLive sessions, a quiz, a midterm exam, and a comprehensive final exam. The final exam accounts for the largest portion of the grade, reflecting the importance of mastering the course material.

Order of Topics in Financial Markets Course at McDonough School of Business

The course follows a structured sequence of topics designed to build a deep understanding of financial markets:

- Time Value of Money – Fundamentals of finance.

- Valuing Government Bonds – Principles of bond valuation.

- Valuing Corporate Securities – Stock valuation and credit analysis.

- Risk and Return – Analyzing portfolio risk and returns.

- Portfolio Theory – Diversification and the efficient frontier.

- Efficient Market Hypothesis – Exploring market efficiency and behavioral finance.

This sequence ensures that students gradually build their knowledge, culminating in a comprehensive understanding of financial markets and their applications in real-world finance.

Tutoring for Financial Markets at the McDonough School of Business, Georgetown University

GraduateTutor’s finance tutors offer live online private tutoring for Financial Markets and other corporate finance, investment, and portfolio management courses offered at Georgetown University. Please email or call us if we can provide you with corporate finance tutoring for Financial Markets or any one of the finance courses from the finance department at Darden, UVA, listed above. Or, for that matter, any other quantitative course you will encounter in a b-school program.