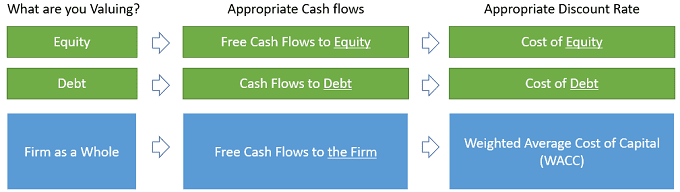

Apples to apples and oranges to oranges. Different types of cash flows need to be discounted with different types of discount rates. How do you decide which discount rate is the appropriate discount rate for the different types of cash flows you will encounter?

When valuing the equity component of a firm using the free cash flow to equity, we discount the free cash flow to equity by the cost of equity. Whereas if we are valuing the firm using the free cash flow to the firm, we discount the free cash flow to the firm by the weighted average cost of capital as the firm is funded by debt and equity.