In principle, if an operating lease is genuinely an operating expense, it must continue to be shown as an expense and treated accordingly. However, if it was structured to avoid taking on debt, it must be capitalized. Capitalized simply means that it must be treated as a capital asset.

In practice, you treat the operating lease in accordance with the rules prescribed by the SEC. We address the steps required to capitalize an operating lease below.

Value the operating asset: You value the operating asset by summing up the present value of all committed lease payments. Use the pre-tax cost of debt as the discount rate assuming you borrowed money at that rate to fund the asset.

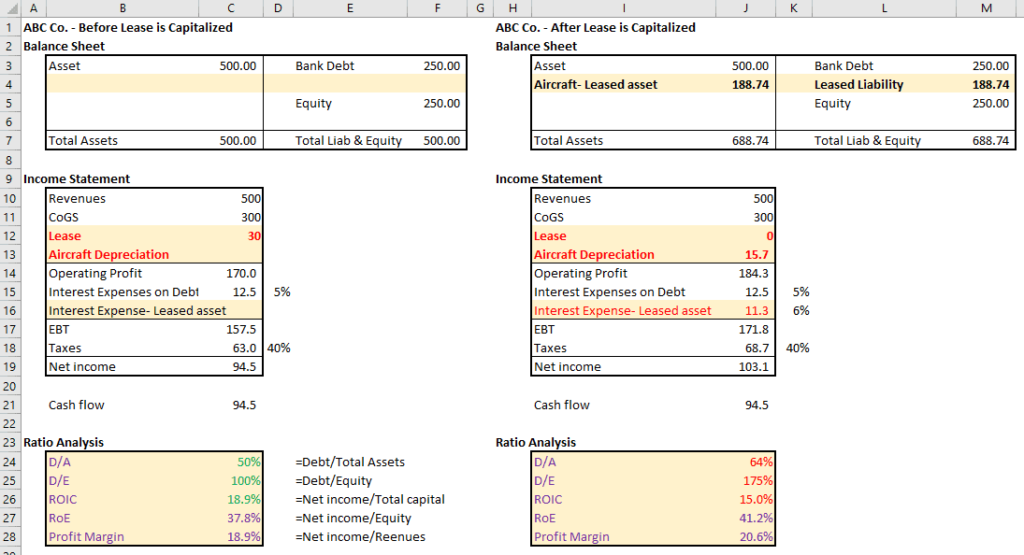

Leased Asset Liability in the Balance Sheet: The value of the operating asset arrived at above is considered as debt. This is reflected in the liabilities side of the balance sheet as a line item as a Leased Asset Liability.

Leased Assets in the Balance Sheet: The value of the operating asset arrived at above is considered the gross value of the operating asset. The gross value of the operating asset is reflected in the assets side of the balance sheet in a line item – Gross Value of Leased Assets.

Depreciation of Leased Asset in the Income Statement: The leased asset is depreciated at the appropriate depreciation rate. The depreciation each year is expensed in the income statement.

Net Book Value in the Balance Sheet: The leased asset is depreciated at the appropriate depreciation rate and captured in the accumulated depreciation of the leased asset. The Net Book value of the leased asset is the gross book value less the accumulated depreciation of the leased asset and is placed in the balance sheet under property, plant, and equipment or assets.

Operating Lease vs Interest Expense & Depreciation in the Income Statement: The operating lease expense is removed in the income statement. In place of the operating lease, you will have interest expenses on the leased asset liability and depreciation of the leased asset.

This causes the net income and cash flows to differ. The change in cash flows must be properly reflected in the DCF valuation.

You can see an illustration of the steps required to capitalize an operating lease in a Microsoft Excel file here.