The MACC 512: Financial Statement Analysis and Valuation Course at Rice University helps students get better at using financial statements. While this is offered in term I, this is not an introductory level accounting or valuation course and students will need to put in a lot of time and effort to stay on top of this course. In Professor Benjamin Lansford’s words, you will learn to “extract, interpret, and use information from financial statements.” You’ll learn to dig into financial data, understand a company’s profitability, and assess how it compares to other companies. By the end of the course, you’ll be able to read and interpret financial statements, make financial forecasts, and use valuation methods like discounted cash flow (DCF) to determine a company’s intrinsic value.

We as tutors at GraduateTutor.com provide one on one private online tutoring for the Financial Statement Analysis and Valuation Course at the Jesse H. Jones Graduate School of Business, Rice University (MACC 512). We cover the following topics on this page:

- Prerequisites for the MACC 512 Financial Statement Analysis and Valuation Course

- Teaching Format for the Financial Statement Analysis and Valuation Course at Rice

- Order of Topics for MACC 512 Financial Statement Analysis and Valuation Course at Rice

- Teaching Faculty Macc 512 Financial Statement Analysis and Valuation Course Jesse H. Jones Graduate School of Business

- Case Studies Used in Financial Statement Analysis and Valuation at Jesse H. Jones Graduate School of Business

- Required Textbook for Financial Statement Analysis and Valuation at Rice

- Key Questions Addressed in Financial Statement Analysis and Valuation at Rice University

- Grading in the Financial Statement Analysis and Valuation Course at Jesse H. Jones Graduate School of Business

- Order of Topics in the Financial Statement Analysis and Valuation Course at Rice

- Tutoring for Other Courses at Jesse H. Jones Graduate School of Business

Prerequisites for the MACC 512 Financial Statement Analysis and Valuation Course

While MACC 512: Financial Statement Analysis and Valuation Course at Jesse H. Jones Graduate School of Business, Rice University is offered in term I, this is not an introductory level accounting or valuation course. You should have a good grasp of basic financial accounting as this course quickly goes deep into the topics covered. You’ll need to be comfortable with the fundamentals since this course dives into advanced topics like financial analysis and valuation techniques.

Teaching Format for MACC 512 Financial Statement Analysis and Valuation Course at Rice

This course combines lectures, case studies, and hands-on assignments. You’ll work through ten cases that help you apply your knowledge to real-world situations. There’s a strong focus on class participation and teamwork, with group projects making up a big part of the course. You’ll also have a midterm and a final exam to test your knowledge.

Order of Topics for MACC 512 Financial Statement Analysis and Valuation Course at Rice University

The MACC 512: Financial Statement Analysis and Valuation Course at Rice starts with financial and accounting analysis. This financial analysis focuses on the firm’s profitability relative to past performance and comparable firms in the industry. Techniques used in financial statement analysis in the first part of MACC 512 at the Jesse H. Jones Graduate School of Business, includes ratio analysis, accounting quality, and earnings management. The MACC 512 – Financial Statement Analysis and Valuation Course then explores financial accounting topics, such as pensions, leases, taxes, restructuring activities, and discontinued operations. The MACC 512 – Financial Statement Analysis and Valuation course then ends with tutoring students using financial statement information for equity valuation. Specifically, you will learn to create and forecast a full set of pro forma financial statements to obtain the firm’s intrinsic value using the discounted cash flow and residual operating income models.

Teaching Faculty for the Financial Statement Analysis and Valuation Course

Benjamin Lansford, Brian Rountree, Ricky Johnston, Sol Wang are faculty who have taught this course at the Jesse H. Jones Graduate School of Business. Each of them brings their own points of view to the course. Recently, it was Professor Benjamin Lansford who taught the MACC 512 – Financial Statement Analysis and Valuation Course at Jesse H. Jones Graduate School of Business, Rice University.

As tutors to for the Financial Statement Analysis and Valuation Course at Rice, we help students understand the concepts covered first. We then help them apply the financial accounting or valuation concepts to the case studies assigned for each topic.

Case Studies Used in Financial Statement Analysis and Valuation at Rice

The MACC 512 – Financial Statement Analysis and Valuation Course at Rice University uses many case studies to teach MBAs practice with financial analysis. Case studies you will tackle include:

- Netflix – Understanding financial disclosures.

- Yum! Brands – Profitability and segment analysis.

- Dollar General vs. Dollar Tree – Advanced profitability comparisons.

- Houston Wire and Cable – Credit analysis.

- Lockheed Martin – Forecasting financial statements.

- Darden Restaurants – Valuing companies using cash flow.

- AE Outfitters – Valuation using Multiples.

- Sherman Williams – Leases.

- Valero Energy – Pensions.

These cases are designed to simulate real-world scenarios and help you apply the concepts you’ve learned in class.

Required Textbook for Financial Statement Analysis and Valuation at Rice University

The course uses the book Financial Statement Analysis & Valuation by Easton, McAnally, Crawford, and Sommers. It’s a solid resource for understanding financial analysis and valuation, and you’ll be using it a lot throughout the semester. Additional materials and resources are also available on Canvas.

Key Questions Addressed in Financial Statement Analysis and Valuation at Rice University

During the course at the Jesse H. Jones Graduate School of Business, you’ll explore key questions like:

- How can financial statements be used to evaluate a company’s performance?

- What are the best ways to detect earnings management?

- How do you create financial forecasts from historical data?

- What valuation methods work best for different types of businesses?

Grading in the Financial Statement Analysis and Valuation Course at Rice University

Your grade in this course comes from a mix of assignments:

- Case Studies (40%) – There are ten cases, and the first is an individual assignment, while the rest are group projects.

- Midterm Exam (25%) – This covers the first half of the course.

- Final Exam (30%) – The final is comprehensive and covers everything from the semester.

- Class Participation (5%) – Your engagement in class discussions also counts.

Order of Topics in the Financial Statement Analysis and Valuation Course at the Jesse H. Jones Graduate School of Business, Rice University

The course follows a logical order, starting with the basics and moving into more complex topics:

- Review of Financial Statements

- Accessing Financial Data

- Profitability Analysis

- Advanced Profitability Techniques

- Credit Analysis

- Revenue and Operating Expenses

- Leases, Pensions, and Taxes

- Financial Forecasting

- Valuing Companies Using Cash Flow

- Valuing Companies with Earnings and Multiples

This progression ensures you build a strong foundation in financial analysis and valuation, helping you apply these skills in future roles.

Tutoring for Other Courses at Jesse H. Jones Graduate School of Business

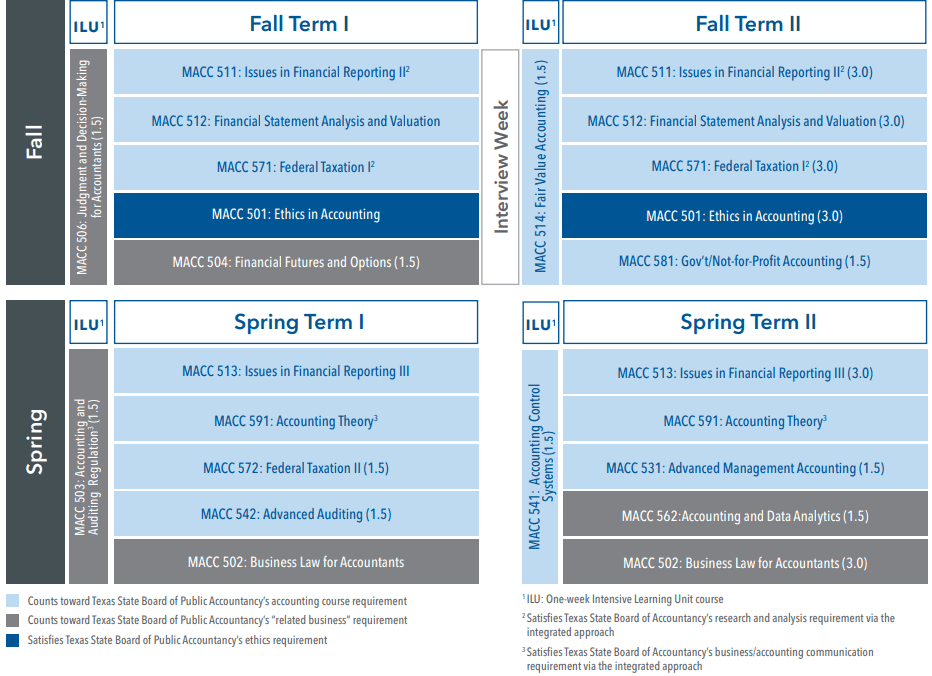

Graduate Tutor can assist you with tutoring on the following courses you may encounter at the Jesse H. Jones Graduate School of Business, Rice University:

- MACC 511 – Issues in Financial Reporting II: Continuation of key financial reporting challenges.

- MACC 512 – Financial Statement Analysis and Valuation: Emphasis on analyzing financial statements for decision-making and valuation.

- MACC 513 – Issues in Financial Reporting III: Advanced financial reporting issues.

- MACC 514 – Fair Value Accounting: Understanding fair value measurements in accounting.

- MACC 531 – Advanced Management Accounting: Techniques for managerial decision-making and control.

- MACC 563 – Data Analytics for Accountants I: Introduction to data analytics in the accounting field.

- MACC 564 – Data Analytics for Accountants II: Advanced data analytics applications in accounting.

- MACC 571 – Federal Taxation: Overview of federal tax principles and compliance.

- MACC 572 – Taxes and Business Strategy: Tax strategies for business planning.

- MACC 504 – Finance for Accountants: Key financial concepts tailored for accountants.

- MACC 506 – Judgment and Decision Making for Accountants I: Decision-making processes and behavioral considerations in accounting.

GraduateTutor’s accounting tutors offer tutoring for The MACC 512: Financial Statement Analysis and Valuation Course at Jesse H. Jones Graduate School of Business, Rice University. Tutoring is a collaborative and flexible process that requires an understanding of the course material, the student’s learning style, and the course instructor’s expectations. By following the outlined approach, tutors can help students achieve academic success in courses like The MACC 512: Financial Statement Analysis and Valuation Course at Rice so students are well-prepared for exams and future professional challenges.

GraduateTutor’s accounting tutors offer tutoring for all of Jesse H. Jones Graduate School of Business, Rice University’s accounting courses. Please email or call us if we can provide you with accounting tutoring for financial accounting or managerial accounting. Or, for that matter, any other quantitative course you will encounter in a b-school program.