“Follow the money”

Did your cash balance increased or decreased over the last year? How or Why did it increase? What is your response? If I were to pose the equivalent question to a company, I might be given the cash flow statement as the answer.

I look at the cash flow statement to understand how the company generated or consumed its cash resources during the period. I should be able to answer the following questions after I review the cash flow statement of a company:

- Did the company increase or decrease its cash and cash equivalents during the period?

- How much money did the company generate from its operations?

- How much money did the company invest in its business?

- Did the company sell any assets?

- How much money did the company pay its shareholders and lenders?

- Did the company raise money from its shareholders and lenders?

The cash flow statement highlights the company’s cash spent or generated from its operating, investing, and financing activities.

‘Cash Equivalents’ is a term applied to highly liquid investments as well as marketable securities that can be converted into known amounts of cash. Therefore, the cash flow statement considers both cash and cash equivalents alike and explains the changes in the total cash and the cash equivalents.

Overview of the Cash Flow Statements

While the balance sheet of the company can tell me what the cash and cash equivalents balance at the beginning of the period and the end of the period were, it cannot tell me how the company generated or consumed the cash. It is the cash flow statement that tells me how the company generated or consumed its cash and cash equivalents.

The cash flow statement categorizes its cash activities into three categories:

- Operating activities;

- Investing activities; and

- Financing activities.

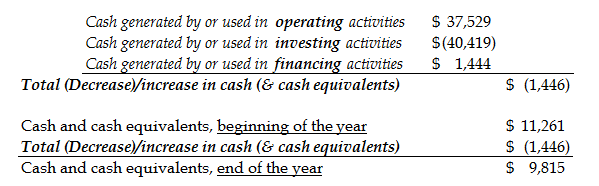

The sum of changes in these three categories will reflect the overall increase or decrease of cash and cash equivalents during the period. This sum of the changes, when added to the cash and cash equivalents at the beginning of the period, will give me the cash and cash equivalents at the end of the period.

Select figures from Apple, Inc.’s 2011 Cash Flow Statement

If we look at Apple’s cash flow statement and pull out this information, we will see that Apple generated $38 billion dollars of cash from its operations. It invested about $40 billion of cash into its business. Apple also raised $1.4 billion in funds to invest in the business. The net impact of this was a negative $1.4 billion indicating that it has $1.4 billion less cash and cash equivalents than it had at the beginning of the year. What do you notice in the cash flow statements of Google, Wal-Mart, and American Airlines?

Operating Activities Section of the Cash Flow Statements

The term “operating activities” refers to the core activities of the company or business. It consists of the activities involved in selling goods and/or providing services that generate revenues and expenses for the company. The operating activities of a business will depend on the nature of the business. For example, the operating activities of a watch company will be the manufacturing, marketing, and selling of watches. The purchase and sale of land will be considered as an operating activity for a real estate company.

The operating section of a cash flow statement may be presented in two ways: the indirect method and the direct method. Most companies use the indirect method to report the cash flow statement because the accounting processes and systems commonly used make this convenient. The indirect method starts with the net income figure derived from the income statement and adds or subtracts the difference between cash collected and amounts presented in the income statement to arrive at the actual cash position from operations. It also removes the non-operating activities that were included in the income statement. The direct method presents the cash collected by the business from operations and subtracts the cash paid for operating activities.

We will not study the mechanics of computing the cash flow from operating activities of either the direct or indirect method at this level. At this level, it is sufficient to understand the total amount of cash generated by or used in operating activities.

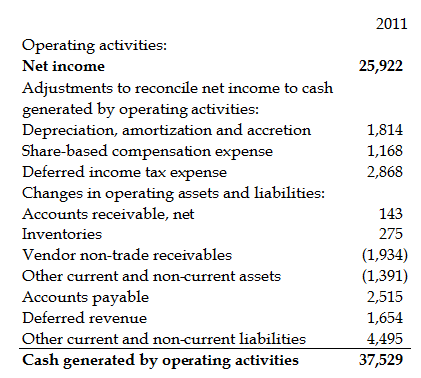

Operating activity section of Apple, Inc. 2011 Cash Flow Statement

We can see that although Apple has reported a net income of only $25 billion, it has generated $38 billion from its operating activities. How much cash has Google, Wal-Mart, and American Airlines generated or used in operating activity according to their respective cash flow statements?

Investing Activities Section of the Cash Flow Statements

A company will need to spend money on assets like equipment, buildings, land, etc., to grow or maintain its business. A company will also sell these assets when they are outdated or when it needs to fund the purchase of new assets. These activities are categorized as investing activities. The investing activities section of the cash flow statement will include both the cash generated by selling assets and the cash spent in buying assets. Cash outflows are indicated by negative numbers, and cash inflows are indicated by positive numbers in the investing section of the cash flow statement.

The investing activities of a business will depend on the nature of the business. For example, the purchase of land will be considered as investing activity for a watch company while it will be considered as an operating activity for a real estate company.

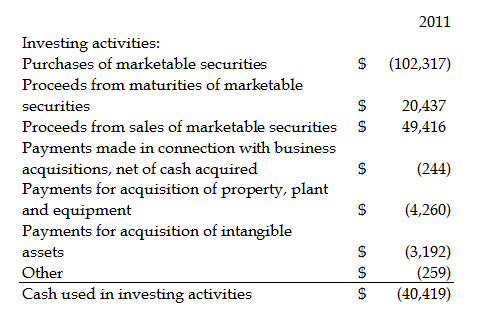

We can see that Apple has both sold and bought assets from the investing section of its cash flow statement. The net impact of Apple’s investing activities is the use of $40 billion of cash and marketable securities. How much money has Google, Wal-Mart, and American Airlines used or generated from investing activities?

Investing activity section of Apple, Inc. 2011 Cash Flow Statement

Financing Activities Section of the Cash Flow Statements

Any activity that involves providing funds to a company is categorized as a financing activity. This includes issuing shares, borrowing money, paying dividends, paying interest on money borrowed, etc. Cash outflows are indicated by negative numbers, and cash inflows are indicated by positive numbers in the financing section of the cash flow statement.

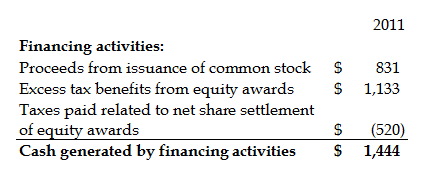

The financing activity section of Apple, Inc. 2011 Cash Flow Statement

We can see that Apple issued stock in 2011. It also gained tax benefits and paid taxes related to the issue of stock in 2011. The net impact of these financing activities was a $1.4 billion cash flow into the company.

Insight Gained from the Cash Flow Statements

The cash flow statement will reveal the liquidity position of the company. It will show you if the company will be able to fund its operations without resorting to outside funds. This is important in preparing for and surviving lean periods or economic downturns.

The cash flow statement also reveals the life stage of a company. Is a company growing, mature, or declining? A growing company may have a negative cash flow from operating and investing activities and a positive cash flow from financing activities as it continues to consume money to grow. A mature firm will have a positive cash flow from operating activities and possibly a negative balance in its investing activities. A declining firm may have a positive cash flow from operating and investing activities and a negative cash flow from financing activities as it uses money from its business to pay back its investors.

Select figures from Apple, Inc. 2011 Cash Flow Statement

Looking at Apple’s cash flow statement, we can see that Apple is a mature company generating significant cash flow from operating activities and making significant investments to grow its business. What would you conclude about Google, Wal-Mart, and American Airlines?

Summary of the Cash Flow Statement

The cash flow statements show how the company generated or consumed its cash resources during the period. The cash flow statement categorizes its cash activities into three categories which are operating activities, investing activities, and financing activities. The sum of changes in these three categories will reflect the overall increase or decrease of cash and cash equivalents during the period. This increase or decrease, when added to the cash and cash equivalents at the beginning of the period, will give me the cash and cash equivalents at the end of the period. The cash flow statements reveal the liquidity position of the company. It also indicates the life stage of a company as growing, mature, or declining. Understanding the cash flow statements is very important because it is the ability to generate cash flow that determines the true value of a business.

Next Steps: Now that you have a good understanding of what is in a cash flow statement and how to read a cash flow statement in a company’s annual report, why don’t you head over to either:

- Learn how to read an income statement; or

- Learn how to read a balance Sheet; or

- Learn how to understand and interpret percentage statements.

If you are looking to build or model financial statements in Microsoft Excel, look no further than our collection of books here.

- Modeling Projected Financial Statements (Without a Plug!);

- Modeling Leveraged Buyouts – Simplified!;

- The ABCs of DCF Valuation and Modeling;

- 101 Private Equity & Investment Banking Interview Questions & Answers.

If you have questions or need help with figuring out a cash flow statement, feel free to call our accounting or finance teams, and we will be happy to assist you.